Choosing the Best CFD Broker

In the world of financial markets, orientation in the field of trading contracts for difference (CFDs) requires a particularly deep understanding of the subtleties involved. On the investor’s way to profit from the price difference, choosing a CFD broker becomes the first key decision. The article discusses the process of choosing the best CFD broker, as well as outlines key considerations that can significantly affect the trading experience and overall success in the dynamic CFD markets. Choosing the best CFD broker is an important decision that affects the further path of a trader in the financial markets. The broker serves as a gateway to the CFD trade world, helping to gain further general trading experience. The chosen broker is indirectly involved in achieving the success of the trader — from compliance with regulatory requirements to the effectiveness of the CFD trading platform.

Understanding CFD Trading

Definition and explanation of CFD trading

CFD trading is a financial instrument that allows traders to speculate on the price movements of various assets without owning the assets themselves. In CFDs, the buyer and seller agree to exchange the difference in the value of the financial asset from the moment the contract is opened until it is closed. This trading method allows investors to benefit from both upward and downward price fluctuations, offering flexibility and potential profits in various market conditions.

CFD trading is a complex financial instrument that has gained huge popularity in recent years due to its flexibility and variety of traded assets. In essence, a CFD is a contract between a buyer and a seller in which the parties agree to exchange the difference in the value of the underlying asset from the moment the contract is opened until it is closed. At its core, CFD trading allows investors to speculate on price fluctuations of various financial instruments without owning real assets. These CFD trading instruments can include stocks, indices, currencies, commodities, and more. The trader does not own the asset but enters a contract with a broker based on fluctuations in the asset price.

Like any trading instrument, CFDs have their own set of advantages and disadvantages. On the positive side, CFD brokers provide direct market access to a wide range of markets, allowing active traders to benefit from various financial instruments without having to open multiple retail CFD accounts. In addition, the ability to open long positions (buy) or short positions (sell) provides flexibility, allowing retail traders to make profits in both rising and falling markets.

However, the leveraged trading inherent in CFD trading requires caution. It can let retail CFD accounts lose money increasable. While it can increase profits, it equally can damage initial investment and make CFD accounts lose money. Novice traders may find themselves in a dangerous position if they are not fully aware of the risks associated with trading on margin account using leverage. Risk management strategies, such as setting stop losses, are becoming an integral part of successfully navigating the CFD trading market.

In the dynamic world of finance, understanding CFD trading is a valuable skill for investors looking for a variety of opportunities. With the right knowledge and risk management strategies, traders can use the potential of CFD trading to achieve their financial goals.

Key features and benefits of CFD trading

Why trade CFDs? CFD trading boasts several key features and advantages that attract a wide range of investors. One of the key features of CFDs is the use of leverage. Leverage allows traders to control a larger position size with a relatively small amount of capital. While this may increase profits, it also increases the risk of significant losses. Therefore, understanding how to manage leverage is crucial in CFD trading.

The use of leverage is a characteristic feature that allows traders to control larger positions with relatively lower capital costs. This increases both potential profits and losses, emphasizing the importance of risk management. In addition, CFDs provide access to a wide range of markets, including stocks, indices, currencies, and commodities, offering traders unprecedented trading opportunities and portfolio diversification. The ability to open long or short positions combined with the potential of hedging strategies further enhances the versatility of CFD trading.

Risks associated with CFD trading

Although CFD trading offers significant benefits, it is extremely important to recognize and understand the risks involved. Although trading contracts for difference offers lucrative opportunities, it is important for traders to be aware of the potential risks associated with this financial instrument. Understanding these risks is of paramount importance for making informed decisions and developing effective risk management strategies.

✔ Leverage is a double-edged sword in CFD trading. While this allows traders to control larger positions with a small amount of capital, it also increases both profits and losses. High leverage can lead to significant financial risk, especially in volatile markets. Traders should use leverage wisely and be aware of the potential for quick losses.

✔ The prices of CFDs are directly related to the market price of the underlying assets. Market fluctuations, which are influenced by various factors, such as economic indicators, geopolitical events, or news of a particular company, can affect CFD prices. Sudden and unexpected market movements can lead to significant losses, which underlines the need for constant monitoring of the market.

✔ Liquidity refers to the ease with which an asset can be bought or sold without affecting its price. In some CFD markets, there may be a decrease in liquidity, especially during times of economic uncertainty or during off-hours trading. Low liquidity can lead to an increase in supply and demand spreads and problems when concluding transactions at the desired prices.

✔ CFD trading involves a contractual relationship between a trader and a CFD provider (broker). If a broker runs into financial difficulties or becomes insolvent, this may affect the trader’s ability to withdraw funds or close positions. Choosing a reputable and well-regulated broker is crucial to reducing counterparty risk.

✔ The simplicity of online CFD trading platforms can incline traders to overtrade – excessive buying and selling based on emotional reactions rather than a well-thought-out strategy. Emotional decision-making can lead to impulsive actions that increase the likelihood of losses. Traders should adhere to disciplined trading plans and avoid making decisions dictated by fear or greed.

✔ While CFD trading is regulated in many jurisdictions, some markets may have less stringent regulatory oversight. Traders should choose brokers whose activities are regulated by reputable authorities to ensure fair practices and investor protection. Unregulated or poorly regulated brokers can expose traders to higher risks.

✔ To successfully deal with the risks associated with CFD trading, traders should prioritize education, apply sound risk management strategies, and stay informed of market conditions. By recognizing these risks and eliminating them, traders can increase their ability to make informed decisions and develop a sustainable approach to trading.

Criteria for Selecting the Best CFD Broker

Regulatory Compliance and Security

In CFD trading, regulatory compliance and security are the cornerstones when choosing the best broker. If a broker is under the supervision of regulatory authorities, this provides a certain level of confidence in the integrity of its practices and financial stability.

Trading Instruments and Markets

A variety of trading instruments and access to global markets play a key role in evaluating brokers and choosing the best CFD broker. Traders are looking for a broker that offers a wide range of assets to trade, including stocks, indices, commodities, and cryptocurrencies. The presence of suchdiversity allows investors to form well-diversified portfolios and benefit from opportunities in various sectors. In addition, the key criterion is the ability to access global markets, allowing traders to navigate the international landscape and use opportunities beyond regional borders.

Trading Platforms and Tools

Convenient trading platforms, accessibility for mobile devices and reliable analysis market research tools are the most important components for any discerning CFD trader when choosing a broker. The easy-to-use platform ensures uninterrupted trading, allowing traders to execute orders efficiently and easily navigate the markets.

The availability of mobile trading applications is no less important in today’s dynamic environment, providing traders with flexibility in monitoring their positions and the mobility of managing and receiving trading signals and notifications on open transactions.

Fees and Commissions

Understanding the fee structure is an important aspect of choosing the best CFD broker. Traders need to be aware of these trading costs to make informed decisions about their trading strategies and profitability. In addition, when choosing a broker, traders should pay attention to potential hidden costs, including in the broker’s commission structure. A comprehensive understanding of capital gains tax and commissions is essential to optimize trading performance and align it with financial goals.

Customer Support and Education

Exceptional customer support and educational resources are vital factors in evaluating a best CFD broker. Traders appreciate brokers who offer reliable assistance to improve their overall trading experience, offer educational resources provided by brokers, such as webinars dedicated to market analysis, trading strategy options, algorithmic robots, or tutorials. A broker seeking to endow traders with knowledge contributes to their success and creates a favorable trading environment. Client support and educational offers provide the trader with a solid foundation for their journey into the world of CFD trading.

Reputation and Reviews

The broker’s reputation and reviews from other traders are invaluable indicators of its reliability and effectiveness. Studying the experience and feedback of other traders provides valuable information about the strengths and weaknesses of a particular broker. By studying this aspect, traders can make informed decisions, coordinating their choice among best CFD brokers with the experience and feedback of the trading community.

Top CFD Brokers in the Market

Let’ s conduct a comprehensive review and comparison of the top CFD brokers, shedding light on the distinctive features that distinguish each of them. By highlighting the strengths and weaknesses of each broker, traders can gain valuable information about the factors that may influence their choice. Also let’s speak about any unique features offered by specific brokers, demonstrating the variety of offers on the market. This knowledge is necessary to make an informed decision when choosing the best CFD broker that suits their individual preferences and trading goals.

Compliance with regulatory requirements and security measures applied by a CFD broker are of paramount importance for traders. Choosing a regulated broker ensures a safe and trustworthy trading environment, in particular a best CFD trading platform. It examines the reasons behind the importance of compliance with regulatory requirements to protect the interests of traders. By understanding and prioritizing regulatory compliance and security, traders can make informed decisions that prioritize the safety of their investments in the dynamic world of CFD trading.

Successful CFD trading depends on effective risk management strategies. In this section, we will look at the implementation of the most important risk management methods. Traders will learn about the importance of setting stop loss and take profit orders, which will allow them to protect their investments and optimize profits. In addition, we will emphasize the importance of the asset class diversification – a key strategy for risk allocation and increasing the overall stability of the portfolio. By mastering these risk management strategies, traders can navigate the complexities of CFD trading with greater confidence and resilience.

RoboForex Ltd.

Founded in 2009, RoboForex Ltd is a prominent figure in the global forex brokers market and is known for its trading automation solutions. The company offers an automated CopyFX trading platform and a bot builder for use. The CFD broker supports a wide range of more than 12,000 CFDs and allows you US stock trading with an exceptionally low commission rate of 0.09 cents per share. Spreads in RoboForex vary depending on the selected account type in the platform interface. For the Eurodollar pair, they range from tight spreads 0.03 to 1.4 points, depending on the various characteristics of the account. It is noteworthy that RoboForex provides a favorable 0% commission policy on all deposits and withdrawals, improving the overall trading experience for its clients.

RoboForex is under the jurisdiction of the Belize Financial Services Commission. In addition, the CFD broker works with a European legal entity and is subject to Cyprus Regulation (CySEC). One of the distinctive features of RoboForex is its civil liability insurance program, offering the best negative balance protection in the industry. This program covers errors, fraud, omissions, negligence, and other potential risks, providing customers with reliable protection against losses.

Interactive Brokers

Interactive Brokers, according to various estimates, received the position of one of the best platforms for trading CFDs in 2023 and offers a wide range of CFDs on various assets. With 8000 shares of large and medium-sized companies from the USA, Brazil, Western Europe, South Africa, Singapore, Hong Kong, Australia and Japan, traders receive a large and diverse selection of financial instruments when working on this platform. When trading US stocks, a commission of $ 0.003–$0.005 per share is charged with a minimum amount of $0.65–$1.

CFDs on indices covering 13 indices for the USA, Western Europe, Australia, Hong Kong and Japan are provided with a commission of 0.005%, or at least $1, which provides discounts for active traders. Contracts for difference in the Forex market cover 85 currency pairs, with a trading commission of 0.08–0.2 basis points with a minimum amount of 1-2 dollars. Probably it is one of the best forex brokers. Interactive Brokers is expanding its offerings to commodities, including London gold and silver. The trading commission for commodities ranges from 0.7–3 basis points, with a minimum of 0-2 dollars. Although cryptocurrency CFDs are not available, the platform compensates for this with various advantages.

The advantages of interactive brokers include a powerful trading platform, integration with the TradeStation platform, the ability to use MetaTrader 4 and 5 through a broker representing the terminal, low trading fees, stock CFDs with a wide selection of more than 8000 worldwide opportunities. However, restrictions include a shortage of goods and the absence of contracts for the difference in prices for cryptocurrency.

Despite this, Interactive Brokers remains the best choice, especially due to its powerful multiple trading platforms and integration capabilities.

Interactive Brokers (IBKR) is the gold standard among brokers, recognized for its extensive international offers of CFDs on stocks, competitive indices and Forex options. Although it may have limited cryptocurrency products, its international users benefit from competitive rates, regardless of their trading style.

The margin percentage and leverage vary depending on the financial instrument and the market, however, IBKR traders enjoy competitive rates because the broker offers some of the best standard margin trading rates in the industry. In addition, IBKR boasts low commissions for CFD trading, which also contributes to its attractiveness.

Traders using the IBKR workstation and trading forex benefit from the two best CFD trading platforms available. Even though these platforms require training, the success of IBKR’s experienced CFD traders base testifies to their effectiveness, and the track record of CFD traders is among the best in the industry.

Pocketoption

Launched in 2017, PocketOption is a broker that provides its clients with access to a wide range of trading assets, including currency pairs, commodities, stocks, cryptocurrencies, and indices. The company has its own trading platform and expands trading software opportunities to MT5. Available in more than 95 countries and regions around the world, PocketOption focuses on high-quality customer service, continuous improvement of trading technologies and financial innovation.

PocketOption customers enjoy a variety of bonus offers and participate in a profitable affiliate program. Thanks to the unique rewards, traders can increase their profile level by purchasing resources in the Market Pocket Option store to increase profitability during trading. The broker provides leverage as a tool that allows traders to open larger positions and participate more actively in their chosen markets, even with a modest initial deposit. PocketOption offers a maximum leverage of 1:100 on its MT5 forex retail CFD accounts.

Operated by PO Trade (SV) Ltd, registered in Saint Vincent and the Grenadines, PocketOption provides brokerage services in the Caribbean offshore tax haven. Although the company claims to be regulated by the International Center for Regulation of Relations in Financial Markets (IFMRRC), it is important to note that IFMRRC is not an official regulatory body.

TradeStation Global

TradeStation Global stands out as one of the leading CFD trading platforms offering a wide range of stock CFDs, indices and forex. Focusing on integration with leading trading platforms, it attracts traders who value access to the best available tools. As for CFD offers, TradeStation Global provides access to shares of large and medium-sized companies in the USA, Western Europe, Australia, Hong Kong, Japan and Singapore. The commission for trading US shares on a competitive basis is set at $0.007 per share with a minimum amount of $1.50.

For index price difference contracts, TradeStation Global offers 13 indices covering the USA, Western Europe, Australia, Hong Kong and Japan. The commission for trading these indices ranges from 0.0015–0.015%, with a minimum of $ 1.50. TradeStation Global offers Forex traders 26 available currency pairs. The commission for CFDs on forex trading is 0.6 basis points, at least 2 US dollars.

Although TradeStation Global does not offer commodity price difference contracts or CFDs on cryptocurrencies, its strengths lie in integration with platforms such as IBKR, TradingView and TradeStation trading programs. This integration allows traders to trade CFDs using the capabilities of these platforms to improve their experience.

TradeStation Global, as a representative broker, relies on IBKR to make CFD trades and hold positions. This partnership provides access to one of the highest execution speeds among CFD brokers. However, in terms of trading commissions and available CFD products, IBKR is superior to TradeStation Global.

For traders who prefer the TradeStation platform, TradeStation Global provides smooth integration. The inclusion of TradingView, a widely used charting application, further enhances its appeal.

With 7,000 share price difference contracts, TradeStation Global competes closely with 8,000 IBKR offers. The unique products in each catalog make it worthwhile to explore both platforms to meet specific trading needs. Although TradeStation Global may not be the optimal choice for certain CFD trading strategies in the Forex market, given the limitation of individual currencies rather than pairs, it perfectly provides a powerful built-in trading program. The desktop platform includes 10 custom chart types, 150 indicators and the versatility of EasyLanguage, a simplified English trading code. Additional innovations, such as RadarScreen and Matrix, contribute to the transformation of TradeStation Global into one of the best CFD trading platforms available.

Exness

Founded in 2008, Exness stands out as the optimal broker for both active and passive investment, offering a wide range of trading instruments, reliability and innovation. Adapting its offers to the diverse needs of traders, Exness provides cent and demo account for beginner CFD traders to avoid losing money rapidly, as well as ECN retail investor accounts with low spreads from 0.1 points for active traders.

The broker operates through registered offices in the British Virgin Islands, Seychelles, Curacao, South Africa and Cyprus. It is important to note that retail customers cannot receive services in offices in Cyprus or in the UK. Exness adheres to strict regulatory standards, having licenses from more than one financial sector conduct authority: Cyprus Securities and Exchange Commission (CySEC) and the UK Financial Supervision Authority (FCA). In addition, Exness is subject to regulation by the Financial Services Authority (FSA) and the FSCA as a securities dealer in South Africa.

All this makes the broker a proven, reliable, and stable partner for everyone who actively trades CFDs on financial markets.

XTB Brokers

XTB Brokers stands out as the best choice for CFD trading on the Forex markets, offering a wide range of tools and functions adapted to the needs of European traders. XTB provides access to more than 2,100 shares of large and medium-sized companies in the United States and Western Europe. The trading commission is organically integrated into the spread.

As for index CFDs, XTB offers more than 20 indices covering regions such as the USA, Brazil, Western Europe, India, Australia, China, Vietnam, Hong Kong and Japan. As in the case of trading stocks, the commission is included in the spread. Forex traders benefit from 48 currency pairs whose trading commissions are included in the spread. XTB boasts some of the lowest spreads on the Forex market, starting at an impressive 0.001%.

Commodity CFDs are another strength, with 28 instruments available and a trading commission included in the spread. Noteworthy are XTB’s cryptocurrency offerings with more than 10 affordable CFDs and competitive spreads starting from 0.22%.

The advantages of trading with XTB include XTB’s powerful proprietary xStation 5 trading platform, which integrates seamlessly with popular platforms such as MT4/5. The broker also stands out for its round-the-clock customer support service helping five days a week. In addition, XTB provides negative balance protection, improving risk management for traders. Even though XTB offers a reliable trading environment, it is important to note a couple of drawbacks. There is no guaranteed protection against stop loss, and the validity period of a paper trading account is limited to four weeks.

XTB, headquartered in Poland, has a strong European focus and branches in 12 countries. The broker gives priority to forex trading, focusing on competitive spreads and an individual approach to customer service. XTB offers both standard and professional retail CFD accounts, with the latter charging a commission but having lower spreads. The xStation 5 web platform, designed with functionality and usability in mind, complements the MetaTrader 4 or 5 platforms, meeting the needs of traders with different preferences.

IC Markets

IC Markets stands out as the world’s largest forex broker with a significant trading volume and surprisingly low spreads, starting from 0.1 points. With commissions of only $3 per lot, IC Markets provides direct access to liquidity and operates without a dealing center, which contributes to its ability to offer narrow spreads thanks to advanced technologies.

Working in the Forex market for more than ten years, IC Markets strives to provide clients with optimal market conditions. Constantly improving its tools and technologies, the broker strives to offer traders accurate analytical tools, updated trading platforms and excellent communication capabilities.

IC Markets Global is overseen by regulatory bodies such as the Seychelles Financial Services Authority, the Cyprus Securities and Exchange Commission and the Australian Securities and Investments Commission, ensuring compliance with industry standards.

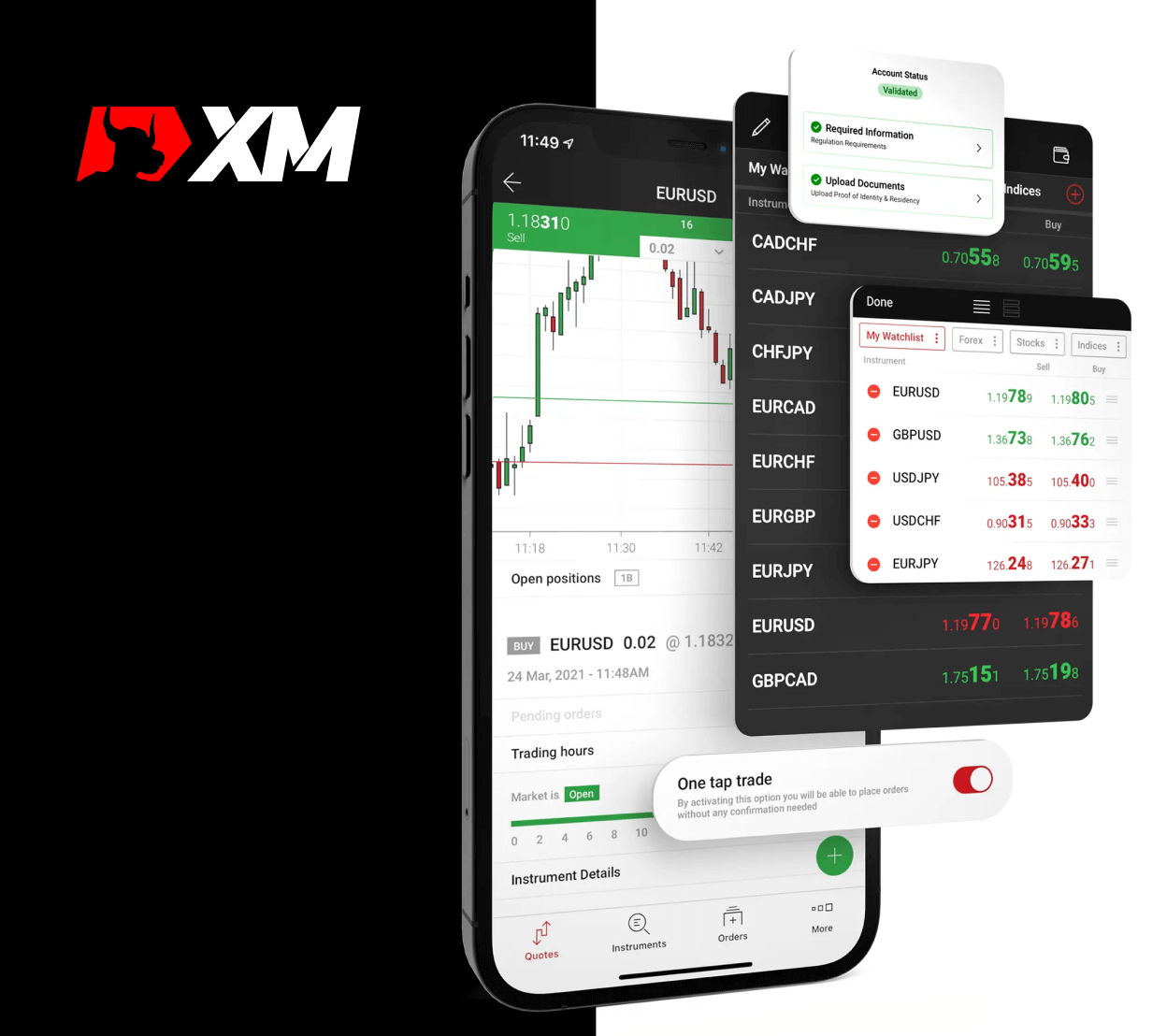

XM

XM is becoming a CFD trading platform for MetaTrader enthusiasts, offering a well-balanced set of tools and functions adapted to the needs of traders. With regard to equity CFDs, XM provides access to a diverse portfolio of more than 600 stocks of large and medium-sized companies in the United States, Canada, Brazil and Western Europe. The trading commission is easily integrated into the spread.

Index CFDs are a strength covering major global indices and future CFDs for regions such as the USA, Western Europe, Hong Kong and Japan. As in the case of stocks, the trading commission is built into the spread.

Forex traders will find a comprehensive offer of more than 50 currency pairs, with the trading commission included in the spread. Commodity price difference contracts are available, including 14 contracts for price differences for precious metals, energy and other commodities. As with other instruments, the trading commission is integrated into the spread.

Although XM excels in many areas, especially in customer service and narrow spreads on major currency pairs, it faces limitations. It is noteworthy that CFD spreads on cryptocurrencies can reach 2%, which makes them one of the most expensive options in this category. In addition, XM is limited to MT4/5 trading platforms, which may pose a problem for traders accustomed to other platforms.

The advantages of trading with XM include a user-friendly interface, a well-balanced range of CFD offers and round-the-clock customer support available five days a week in 30 languages.

Despite its dependence on the MetaTrader platforms, XM has gathered an extensive user base, which indicates its competence in various aspects, including the quality of execution. XM boasts a reputation as an impeccable performer: 100% of orders are executed without requotes or deviations. In addition, 99.35% of all orders are executed in one second or less. In addition, XM offers guaranteed protection against stop losses in the Forex market.

As with any broker, the suitability of XM depends on individual trading strategies. With a minimum deposit requirement of just $5, traders can easily test the platform to assess how well it fits their trading orientation and style.

Tickmill

Founded in 2014, Tickmill is becoming the preferred choice for professional traders, paying great attention to innovation. In addition to manual trading, Tickmill offers automatic transaction copying services for those who want to benefit from the experience of more experienced traders.

Tickmill’s commitment to innovation sets it apart from others, which makes it an attractive option for traders of all levels, especially for those who are starting to trade Forex for the first time. Due to low spreads and convenient trading conditions, Tickmill provides a 0.1 point spread for EUR/USD currency pairs, satisfying both manual and automatic trading preferences.

Regulated by the Seychelles Financial Services Authority, the UK Financial Supervision Authority and the Cyprus Securities and Exchange Commission, Tickmill ensures the safety and reliability of traders’ funds, adding an additional layer of security to the trading experience. This makes the broker a proven, reliable and stable partner for everyone who actively trades CFDs in financial markets.

eToro

eToro stands out as the optimal choice for CFD trading, offering a wide range of tools and user-friendly utilities, especially well-suited for beginners. For contracts for difference in stock prices, eToro provides access to 3,000 shares listed on the NYSE and Nasdaq exchanges. The trading commission is set at 0.15%.

Index price difference contracts cover 20 indices in the USA, Western Europe, Australia, Hong Kong, China, Japan, and global markets. The commission for trading varies from 0.02 to 10 points, calculated based on the amount of the index in dollars. Forex traders will find more than 50 currency pairs on eToro. Trading commissions for pairs with low volatility range from 0.01–0.07%, while for pairs with high volatility they range from 0.2-1.2%.

CFDs on commodities are represented in large numbers, there are more than 30 of them. The trading commission for most precious metals’ ranges from 0.04 to 0.45%. The choice of cryptocurrencies is represented by more than 70 CFDs with a single trading commission of 1%.

However, it is important to note that eToro supports retail investor accounts only in US dollars, which may be a limitation for some users. eToro, based in Israel, is registered in the USA, the UK, Cyprus, and Australia. With its global reach, the broker has attracted 27 million users in 140 countries. CFD trading is an important component of its offerings, making it an ideal trading platform for beginners. Users can access the portfolio of experienced traders with different approaches, and even could copy their trades for free. The eToro demo account with a virtual portfolio of $100,000 allows beginners to practice strategies in a risk-free environment.

Tips for Successful CFD Trading

Risk Management Strategies

Having a well-defined trading strategy is the cornerstone of successful CFD trading. The trading plan includes setting realistic goals and monitoring indicators during the trading process. Continuous learning and adaptation are important components of successful CFD trading. It is extremely useful to be aware of market news and events, providing with tools for making informed decisions in order to avoid CFD traders lose money. By including continuous training and adaptation in their approach, traders can improve their skills and confidently navigate the emerging CFD market.

Developing a Trading Plan

Having a well-defined trading strategy is the basis for successful CFD trading. Traders will get an idea of the elements that make up an effective trading strategy, bringing their actions in line with their overall financial goals.

Continuous Learning and Adaptation

Continuous learning and adaptation are important components of successful CFD trading. It is extremely useful to be aware of market news and events that provide traders with arguments and facts for making informed decisions. By including continuous training and adaptation in their approach, traders can improve their skills and confidently navigate the emerging CFD market. Choosing a well-informed online CFD broker is undoubtedly crucial to the success of any trader and affects the potential for profitable results.

Conclusion

Summarizing the main considerations when choosing a broker, it is extremely important to emphasize such factors as compliance with regulatory requirements, security measures, available trading tools, commissions, customer support and the overall reputation of the broker. By combining these aspects, traders can develop a comprehensive understanding of what makes a broker optimal for their individual needs and preferences.

It is recommended to conduct a thorough research before making a final decision about a CFD broker. Taking the time to study the broker’s regulatory status, user reviews and available features, traders tend to make well-thought-out choices that match their financial goals, trading style and risk tolerance.

With a well-chosen broker and a well-defined trading plan, traders can unlock the full potential of CFD trading, turning difficulties into opportunities and achieving their financial goals.